Every financed purchase is paid in installments, in which interest is included according to the rates used by financial institutions or by the store through the provision of installment plans particular. Some stores offer their products in installments, as this type of sale generates more profit for the merchant. interest rates, and sometimes induces the customer to buy by the installment method, saying that the cash and forward values are equals. This type of practice is considered abusive, because every purchase made in cash must be made at a discount or with the value of the product less than the final price of the financed merchandise. We will use an example to demonstrate how a financing system works and how to calculate the current value of a product according to the total value of the installments.

A 32-inch LCD television is sold in four monthly installments of R$500, with the first paid one month after purchase. Knowing that the store operates with a compound interest rate of 4% per month, what is the spot price?

The installment amount of BRL 500.00 one month from now corresponds to the following payment:

x * 1.04 = 500

x = 500/1.04

The amount of the installment in two months:

x * 1.04 * 1.04 = 500

x * 1.04² = 500

x = 500/1.04²

The amount of the installment in three months:

x * 1.04 * 1.04 * 1.04 = 500

x * 1.04³ = 500

x = 500/1.04³

The amount of the installment in four months:

x * 1.04 * 1.04 * 1.04 * 1.04 = 500

x * 1,044 = 500

x = 500/1.044

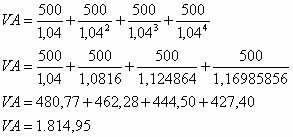

The spot price will be given by the sum:

Using the present value formula based on installment, interest rate, and time.

Note: it will be necessary to use a scientific calculator.

Using the financial calculator

Press the following keys:

500 PMT (installment amount)

4 n (periods)

4 i (interest rate)

PV (present value) = – 1,814.95

by Mark Noah

Graduated in Mathematics

Brazil School Team

Financial math - Math - Brazil School

Source: Brazil School - https://brasilescola.uol.com.br/matematica/calculo-valor-atual.htm