The Severance Indemnity Fund (FGTS) is a benefit that workers dismissed without just cause receive. In this sense, Caixa Econômica Federal released two FGTS withdrawals this month. So check out the details and find out who can withdraw the FGTS twice in February.

Read more: CNH: See when to renew the document in 2022

see more

Is it better to eat boiled eggs for lunch or dinner? Find out here

With me-no-one-can: Meet the plant capable of warding off evil eyes

What are the two FGTS withdrawals in February?

That year, two types of FGTS withdrawals are available, the first of which is the emergency withdrawal for workers residing in areas affected by heavy rains in Bahia and Minas Gerais between the end of 2021 and the beginning of 2022. In this case, it is necessary to reside in one of the affected cities according to the Civil Defense list Municipality, have a balance in the Fund's account and have not made another withdrawal for the same reason in the last 12 months.

In addition, Caixa also released the FGTS Anniversary Withdrawal. As the name implies, the payment is released in the month of birth of the worker, that is, those born in January and February can already carry out the withdrawal. The withdrawal of the amount can be made in up to three months, counting from the month of release. Thus, those born in January can withdraw the benefit until March 31, for example.

What is the withdrawal amount?

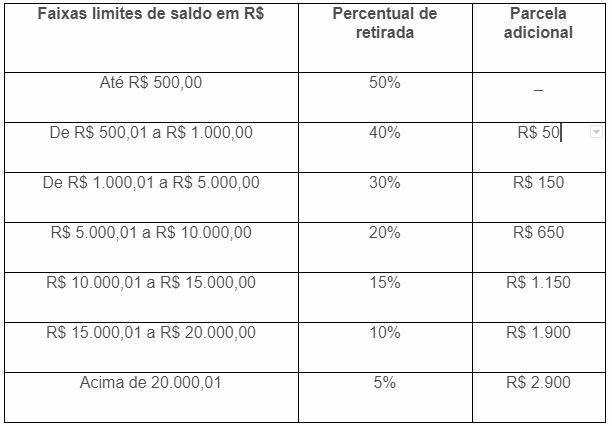

The value of the birthday withdrawal depends on the worker's balance in his FGTS account. Therefore, see the table below for the amounts available for withdrawal:

Anniversary Withdrawal – How to do it?

Every worker with an account linked to the FGTS interested in receiving the benefit must adhere to the birthday withdrawal modality. In this sense, the request can be made through one of Caixa's service channels.

The channels currently available are the following: the FGTS application, which is available for both Android and iOS, the Caixa website (Click here to be redirected), internet banking (for those who have a Caixa account), Caixa Tem application or Caixa branches.