Servers with accounts linked to the FGTS, whose monthly family income does not exceed R$ 2,400, will be able to use the future deposits of the guarantee fund, that is, the amounts that their bosses or companies will continue to deposit in their accounts, to amortize or even to settle debts resulting from financing real estate.

With this, there is the possibility for these workers with a formal contract to add the FGTS amounts received to the family income. This will work as a kind of guarantee, increasing the payment capacity and, in theory, reducing the interest rates applied by the institution.

see more

After hacker attacks, Microsoft releases free tools for…

'Barbie' movie predicted to boost Mattel profits…

Read more: October birthday withdrawal is released by the FGTS

How was this decision regulated?

Sanctioned unanimously in a session held on the 18th by the FGTS Board of Directors, the decision regulates paragraph 27 of article 20 of Law No. 8,036 of 1990. Since 2022, the legislation establishes that the amounts available in linked accounts must be transferred at the discretion of their holders, prior and express authorization in the financing agreement.

According to the Law, the transmission of the right to future withdrawals "may be subject to alienation or fiduciary assignment for payment of part of installments arising from housing finance granted under the [Housing Financial System] SFH, [provided that] observed the conditions established by the Board of Trustees, by guaranteeing the deposits to be made in the worker's escrow account".

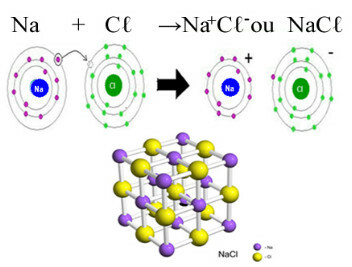

The assignment and fiduciary alienation guarantee the loan. With them, those who contract debt transfer the creditor's right over movable or immovable property, in the case of alienation, or future credit, in the case of fiduciary assignment, as long as the debt exists.

According to Law nº 8.036, it is not possible to guarantee the amounts corresponding to the month in which the employment contract was rescinded, as well as the previous month, if it has not yet been transferred to account.

“Current measures have been very effective and have contributed to facilitating access to credit family," said Helder Melillo Lopes Cunha Silva, executive secretary of the Ministry of Development Regional.

“The financial agent must inform the worker about the ability to pay with and without the guarantee and the amount to be guaranteed. For example: a family that, with its income, obtains a loan of R$ 500, but whose desired property requires a loan whose installments would be of R$ 600, will be able to use the future credit to which she is entitled to make this complementation and access this property that, without this measure, she would not be able to access”, explained the secretary.

Lover of movies and series and everything that involves cinema. An active curious on the networks, always connected to information about the web.