Financing using the Price table is offered for the purpose of fixed installments throughout the period of discharge of the asset, without increase for any type of correction (depending on the contract of financing). The Price method consists of calculating fixed installments, with the debit balance being gradually amortized, until the debt is settled. Interest is included in the installments, then we will build a table specifying the amount of interest paid and amortization over the outstanding balance. That way we will be able to analyze all the monthly steps of a loan.

The following calculations require the assistance of a scientific calculator.

Example

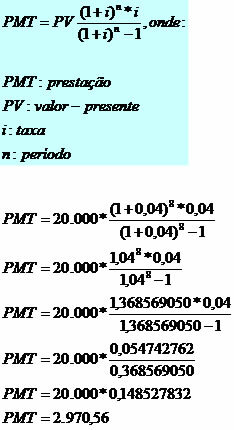

We have a loan in the amount of R$20,000.00 to be repaid in 8 months, with an interest rate of 4% per month.

We must calculate the benefit amount using the following formula:

The amount of the installment will be R$2,970.56.

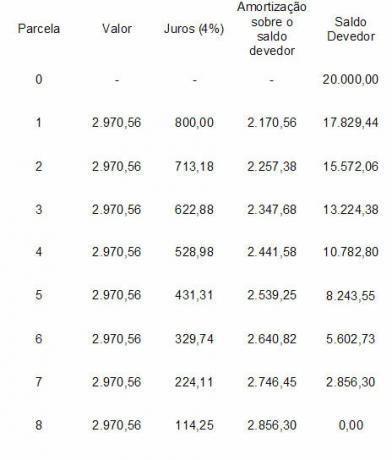

Building the table:

Do not stop now... There's more after the advertising ;)

See that interest is calculated according to the outstanding balance, in installment number 1 we have: 20,000 x 4% = 800.

Amortization is calculated by subtracting the installment amount from the interest amount: 2,970.56 – 800 = 2,170.56.

The outstanding balance of installment 1 is calculated by subtracting: 20,000 – 2,170.56 = 17,829.44.

And so respectively, until the financing is fully paid.

A detail is that interest is decreasing and amortization is increasing.

by Mark Noah

Graduated in Mathematics

Brazil School Team

Financial math - Math - Brazil School

Would you like to reference this text in a school or academic work? Look:

SILVA, Marcos Noé Pedro da. "Funding Using the Price Table"; Brazil School. Available in: https://brasilescola.uol.com.br/matematica/financiamentos-utilizando-tabela-price.htm. Accessed on June 29, 2021.