Tax reform It is a measure that aims to promote changes in the collection of taxes in a given territory. Tax reform is, in this sense, an important resource for a country's economic policy and can bring benefits both to the population and to the companies in operation.

In the Brazilian case, the tax reform approved in 2023 aims to simplify the payment and collection of taxes, fees and contributions at the federal, state and municipal levels. Voted after several decades of discussions, the tax reform has as one of its main proposals the unification of taxes. It is estimated that, once sanctioned, the Brazilian tax reform will be implemented gradually until the year 2033, when it comes into full effect.

Read too: What is inflation?

Topics of this article

- 1 - Summary on tax reform

- 2 - What is tax reform?

- 3 - What is the objective of the tax reform?

- 4 - Tax reform of 2023 in Brazil

- 5 - What changes with the 2023 tax reform?

- 6 - When will the 2023 tax reform take effect?

- 7 - What is the importance of tax reform?

Summary on tax reform

Tax reform is the change made in the collection of taxes (taxes, fees and contributions) in a given territory.

Tax reform serves to promote changes in the way taxes are collected and paid in a country, such as, for example: promoting the extinction of taxes, creating new fees, changing rates, changing the allocation of resources, increasing the range of exemptions, among others measurements.

The Brazilian tax reform was approved in 2023, after decades of discussions about its implementation. Now, its text goes to the Federal Senate.

The main objectives of the tax reform in Brazil are the simplification of taxation through the unification of taxes and the guarantee of a more transparent system.

Initially, the tax reform aims to transform the collection of goods and services and consumption in all spheres.

The five taxes paid today by Brazilians (PIS, Cofins, IPI, ICMS and ISS) will be incorporated into IVA (Value Added Tax).

VAT will be divided into Contribution on Goods and Services (CBS) and Tax on Goods and Services (IBS).

The Federal Selective Tax will also be created, which will be charged on alcoholic beverages, cigarettes and pesticides.

Once sanctioned, the tax reform will go through a transition period and should officially come into force from 2033.

What is tax reform?

Tax reform is the name given to the set of changes made to the charge of taxes in a certain territory. these tributes understand taxes (federal, state and municipal), fees and other forms of contribution that are mandatory both for individuals (the general population) and for companies in operation.

It is, therefore, a measure politicianO-economical changing tax laws and thus promotes significant changes in the way a country collects taxes.

Do not stop now... There's more after the publicity ;)

What is the purpose of tax reform?

The tax reform serves to modify the way in which the collection and collection of taxes and other taxes has been carried out in the country where it is proposed. It should be noted, however, that the amount collected in taxes and tariffs does not necessarily change upon carrying out of a tax reform, which means that in many cases the amount paid in taxes by the population remains the even|1|. What changes is the payment and billing process.

Considering the tax reform approved in Brazil in 2023, this political-economic mechanism aims to simplificationthe tax collection about consumption and about the goods and services in the national territory, which will mainly affect the way in which the Brazilian population pays these taxes.

See too: Individual Income Tax (IRPF) — what it is, who should declare it, exemption

2023 tax reform in Brazil

the tax reform was approved in Brazil in two shifts by the Chamber of Deputies on the 7th of July 2023, through a PEC. The approval of the text of the Proposed Amendment to the Constitution nº 45 of 2019 (PEC 45/19), which determines the institution of a reform in the tax system in Brazil, happened after several other attempts to implement a measure of this type, which had been made since the elaboration process of the 1988 Constitution|2|.

Economists and analysts in this area point out that the difficulty in approving a political-economic reform of this magnitude has always involved conflicts of interest, especially those between the different spheres of tax collection, which are: federal, state and municipal. The tax reform approved by the Chamber of Deputies in 2023 also was guided numerous times, going through lengthy discussions and changes in its text.

PEC 45/19 needed to receive at least 308 favorable votes in each of the rounds. At the end of the voting, the tax reform proposal got 328 votes in favor and 118 against in the first round, and 375 votes in favor and 113 against in the second round. Therefore, the text follows for consideration by the Federal Senate.

What changes with the 2023 tax reform?

The main objectives of the 2023 tax reform are to simplify tax collection in the territory national level and the implementation of a more transparent system so that the Brazilian population knows the fate of their contribution.

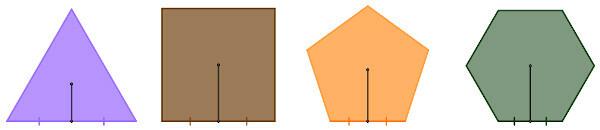

In the first phase of the tax reform, the changes will affect taxes on goods and services and also on consumption. In that regard, the main change is the unification of five different tributes. Of these five, three relate to federal taxes and contributions, while the rest are collected at the state and municipal levels, as shown in the following table.

Taxes paid before the 2023 tax reform | |

federal tax |

PIS - Social Integration Program |

Cofins – Contribution to Financing Social Security | |

IPI - Tax on Industrialized Products | |

State tax |

ICMS - Tax on Circulation of Goods and Services |

City tax |

ISS - Service Tax |

With the approval of the text of the tax reform, after its implementation, these five taxes will be replaced by the Value Added Tax, or IVA, which breaks down into CBS and IBS. In addition, there will be the creation of the Federal Selective Tax, whose main objective is to reduce the consumption of potentially harmful substances for human health and also for the environment.

In the following table we present the table of taxes to be paid by the population after the implementation of the reform tax approved in 2023.

Taxes paid after the 2023 tax reform | |

VAT - Value Added Tax |

Contribution on Goods and Services (CBS): replaces PIS, Cofins and IPI, all from the federal tax collection sphere. |

Tax on Goods and Services (IBS): replaces ICMS and ISS, respectively at the state and municipal collection levels. | |

Federal Selective Tax |

It applies to alcoholic beverages, cigarettes and pesticides. |

Another important alteration that will be introduced with the implementation of the tax reform concerns the allocation of taxes. The two new taxes on goods and services will have their respective values reverted to the location (state or municipality) of destination, that is, for where the property was purchased or for where the service was provided, and no longer at its origin (where the good was produced).

The text of the tax reform provides for the application of a single rate for both CBS and IBS. Even so, there will be a distinction as to the sectors on which this rate will fall. Sectors of great importance for the Brazilian population, such as education, health, culture and public transport, will have reduced rates. In the case of products belonging to the basic basket, the rate will be zero.

Know more: Land reform — what it is, advantages and disadvantages

When will the 2023 tax reform take effect?

As we saw earlier, the tax reform was approved in the year 2023. However, before the proposed changes take full effect, there is still period is required tests and transition for the changes to be implemented gradually in the Brazilian tax system.

The implementation of a single VAT rate will be the first test measure, with the abatement on taxes that this single tax will replace. It is estimated that the CBS will be the first new tax to become effective by 2027, followed by the start of the application of the IBS in 2028|3|. This whole transition process should be completed by the year 2032, and the renovation will become effective in 2033.

What is the importance of tax reform?

Tax reform is an important measure for the economic policy of a territory. Through its implementation it is possible to promote the update of the form how taxes are collected and paid, adapting it to the social and economic context of the country and making it more effective. In this sense, a tax reform like the one approved in Brazil in 2023 is important in terms of simplification and, at the same time, time, in the modernization of the collection of taxes and fees, bringing benefits to companies and, mainly, to the population.

The importance of the Brazilian tax reform also lies in in ensuring greater transparency regarding the payment process and the allocation of the amount paid in taxes in the national territory. Another aspect worth highlighting is the reduction or elimination of rates on essential goods and services provided for in the tax reform, which will play an important role in the daily lives of Brazilians, especially the poorest part of the population.

Grades

|1| BBC. Tax reform advances: how are taxes according to the proposal. BBC News Brazil, 07 Jul. 2023. Available in: https://www.bbc.com/portuguese/articles/czr0jygngymo.amp

|2| POMBO, Barbara. Tax Reform: See the history of proposals, from 1988 to 2023. Economic value, 23 Mar. 2023. Available in: https://valor.globo.com/legislacao/noticia/2023/03/23/reforma-tributaria-veja-o-historico-de-propostas-de-1988-a-2023.ghtml

|3| SAMPAIO, Amanda. Tax reform will be implemented gradually and should be completed in 2033. CNN Brazil, 08 Jul. 2023. Available in: https://www.cnnbrasil.com.br/economia/reforma-tributaria-sera-implementada-gradualmente-e-deve-ser-concluida-em-2033/

Sources

CHAMBER OF DEPUTIES. Tax reform: understand the proposal. Chamber of Deputies, [n.d.]. Available in: https://www.camara.leg.br/internet/agencia/infograficos-html5/ReformaTributaria/index.html.

HENRIQUE, Layane. What do you need to know about tax reform? politicize, 11 Jul. 2023. Available in: https://www.politize.com.br/reforma-tributaria/.

MAXIMUM, Wellton. Understand the tax reform approved by the Chamber. Brazil Agency, 08 Jul. 2023. Available in: https://agenciabrasil.ebc.com.br/economia/noticia/2023-07/entenda-reforma-tributaria-aprovada-pela-camara.

MINISTRY OF FINANCE. Chamber of Deputies approves in two shifts the PEC that makes the Tax Reform. Ministry of Finance, 07 Jul. 2023. Available in: https://www.gov.br/fazenda/pt-br/assuntos/noticias/2023/julho/camara-deputados-aprova-em-dois-turnos-a-pec-que-cria-a-reforma-tributaria.

MINISTRY OF FINANCE. Tax reform. Ministry of Finance, [n.d.]. Available in: https://www.gov.br/fazenda/pt-br/acesso-a-informacao/acoes-e-programas/reforma-tributaria.

MUGNATTO, Silvia. New tax system will be implemented gradually until 2033. News Chamber Agency, 23 Jun. 2023. Available in: https://www.camara.leg.br/noticias/974719-novo-sistema-tributario-sera-implantado-gradualmente-ate-2033/.

PIOVESAN, Eduardo; SIQUEIRA, Carol. House approves tax reform in two rounds; text goes to the Senate. News Chamber Agency, 07 Jul. 2023. Available in: https://www.camara.leg.br/noticias/978334-camara-aprova-reforma-tributaria-em-dois-turnos-texto-vai-ao-senado/.

INDUSTRY PORTAL. Tax reform: What is it and what are the proposals. Industry Portal, [n.d.]. Available in: https://www.portaldaindustria.com.br/industria-de-a-z/reforma-tributaria/.

ESSAY. Tax reform: what should change with the new rule? Exame magazine, 04 Jul. 2023. Available in: https://exame.com/economia/reforma-tributaria-o-que-deve-mudar-com-a-nova-regra/.

ICMS, what is ICMS, how ICMS is calculated, criteria for calculating ICMS, principle of essentiality, Kandir Law, what ICMS is levied, the need for an invoice, taxes.

Understand what the Income Import is and who should declare it. Also learn how fees, refunds, dependent and exempt declarations work and how to make the declaration.

Taxes, what is taxes, definition of taxes, income tax, personal income tax, corporate income tax, irpf, irpj, icms, cpmf, understand taxes, economy, real, inflation, fees.

After all, what is inflation? Access our text and clear all your doubts about this indicator. Understand the consequences of inflation in our daily lives.

Tax, what is tax, taxes, main taxes, tax burden, tax payment, what is the tax for, where does the tax money go, money, revenue, tribute, fee, government, federal government, individual, person legal.

Do you know how Brazil's GDP is calculated? Click here and learn more about the composition of this indicator. Know the state GDPs and also the world ranking.

Have you ever stopped to think why the image of a lion is associated with income tax? Click here and find out!

Find out what the federal revenue is and what its competences are.

Land reform is one of the most controversial issues involving the land structure.

Click here and find out what agrarian reform is, why it is important, where and when it was implemented. Also find out how Brazil deals with the matter.