You Compound interest are calculated taking into account the capital restatement, that is, the interest is levied not only on the initial value, but also on the accrued interest (interest on interest).

This type of interest, also called “accumulated capitalization”, is widely used in commercial and financial transactions (whether debts, loans or investments).

Example

An investment of R$10,000, in the compound interest regime, is made for 3 months at interest of 10% per month. What amount will be redeemed at the end of the period?

| Month | Fees | Value |

|---|---|---|

| 1 | 10% of 10000 = 1000 | 10000 + 1000 = 11000 |

| 2 | 10% of 11000 = 1100 | 11000 + 1100 = 12100 |

| 3 | 10% of 12100 = 1210 | 12100 + 1210 = 13310 |

Note that interest is calculated using the amount already corrected from the previous month. Thus, at the end of the period, the amount of R$13,310.00 will be redeemed.

To better understand, it is necessary to know some concepts used in financial math. Are they:

- Capital: initial value of a debt, loan or investment.

- Interest: value obtained when we apply the tax on capital.

- Interest Rate: expressed as a percentage (%) in the period applied, which can be a day, month, two-month, quarter or year.

- Amount: capital plus interest, that is, Amount = Capital + Interest.

Formula: How to Calculate Compound Interest?

To calculate compound interest, the expression is used:

M = C (1+i)t

Where,

M: amount

C: capital

i: fixed rate

t: time period

To substitute in the formula, the rate must be written as a decimal number. To do this, just divide the given value by 100. Also, the interest rate and time must refer to the same time unit.

If we intend to calculate interest only, we apply the following formula:

J = M - C

Examples

To better understand the calculation, see below examples on the application of compound interest.

1) If a capital of R$500 is applied for 4 months in the compound interest system at a fixed monthly rate that yields an amount of R$800, what is the amount of the monthly interest rate?

Being:

C = 500

M = 800

t = 4

Applying the formula, we have:

Since the interest rate is presented as a percentage, we must multiply the value found by 100. Thus, the amount of the monthly interest rate will be 12,5 % per month.

2) How much interest will a person who invested, at compound interest, the amount of R$5,000.00, at the rate of 1% per month, will receive interest at the end of a semester?

Being:

C = 5000

i = 1% per month (0.01)

t = 1 semester = 6 months

Replacing, we have:

M = 5000 (1 + 0.01)6

M = 5000 (1.01)6

M = 5000. 1,061520150601

M = 5307.60

To find the amount of interest, we must reduce the amount of capital, like this:

J = 5307.60 - 5000 = 307.60

The interest received will be R$307.60.

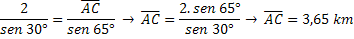

3) What should be the time for the amount of R$20,000.00 to generate the amount of R$21,648.64, when applied at the rate of 2% per month, in the compound interest system?

Being:

C = 20000

M = 21648.64

i = 2% per month (0.02)

Replacing:

Time should be 4 months.

To learn more, see also:

- Compound Interest Exercises

- Simple Interest Exercises

- Simple and Compound Interest

- Percentage

- Percentage Exercises

Video Tip

Get a better understanding of the concept of compound interest in the video below "Introduction to Compound Interest":

Simple interest

You simple interest is another concept used in financial mathematics applied to a value. Unlike compound interest, it is constant by period. In this case, at the end of t periods we have the formula:

J = C. i. t

Where,

J: fees

Ç: invested capital

i: interest rate

t: periods

Regarding the amount, the expression is used: M = C. (1+i.t)

Solved Exercises

To better understand the application of compound interest, check below two solved exercises, one of them being Enem:

1. Anita decides to invest R$300 in an investment that yields 2% a month under the compound interest regime. In this case, calculate the amount of investment she will have at the end of three months.

By applying the compound interest formula we will have:

Mno= C (1+i)t

M3 = 300.(1+0,02)3

M3 = 300.1,023

M3 = 300.1,061208

M3 = 318,3624

Remember that in the compound interest system the income amount will be applied to the amount added each month. Therefore:

1st month: 300+0.02,300 = R$306

2nd month: 306+0.02,306 = R$312.12

3rd month: 312.12+0.02,312.12 = R$318.36

At the end of the third month, Anita will have approximately R$318.36.

See too: how to calculate percentage?

2. (Enem 2011)

Consider that a person decides to invest a certain amount and that three are presented. investment possibilities, with net returns guaranteed for a period of one year, as per described:

Investment A: 3% per month

Investment B: 36% per year

Investment C: 18% per semester

The returns for these investments are based on the value of the previous period. The table provides some approaches for analyzing returns:

| no | 1,03no |

| 3 | 1,093 |

| 6 | 1,194 |

| 9 | 1,305 |

| 12 | 1,426 |

To choose the investment with the highest annual return, this person must:

A) choose any of investments A, B or C, as their annual returns are equal to 36%.

B) choose investments A or C, as their annual returns are equal to 39%.

C) choose investment A, as its annual return is greater than the annual returns of investments B and C.

D) choose investment B, as its profitability of 36% is greater than the returns of 3% on investment A and 18% on investment C.

E) choose investment C, as its profitability of 39% per year is greater than the profitability of 36% per year of investments A and B.

To find the best form of investment, we must calculate each of the investments over a period of one year (12 months):

Investment A: 3% per month

1 year = 12 months

12-month yield = (1 + 0.03)12 − 1 = 1.0312 − 1 = 1.426 – 1 = 0.426 (approximation provided in the table)

Therefore, the 12-month (1 year) investment will be 42.6%.

Investment B: 36% per year

In this case, the answer is already given, that is, the investment in the period of 12 months (1 year) will be 36%.

Investment C: 18% per semester

1 year = 2 semesters

Yield in 2 semesters = (1 + 0.18)2 − 1 = 1.182 − 1 = 1.3924 – 1 = 0.3924

That is, the investment in the period of 12 months (1 year) will be 39.24%

Therefore, when we analyze the values obtained, we conclude that the person should: "choose investment A, as its annual return is greater than the annual returns of investments B and C”.

Alternative C: choose investment A, as its annual return is greater than the annual returns of investments B and C.