The American Amortization System is a type of loan repayment that favors those who wish to pay the principal amount in a single installment, however, interest must be paid periodically or, depending on the agreement entered into between the parties, interest is capitalized and paid together with the principal amount. Look at the statement sheets for this amortization model.

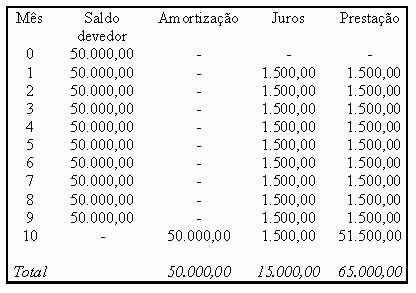

Example 1

A loan of R$50,000 will be paid through the US system within 10 months, at monthly interest of 3% per month. Look:

According to the American repayment model, the repayment of the loan will take place in the last month, so in the previous months the person will only pay the interest amount.

Interest = 3% of 50,000 = 1,500

Note that interest from the last period is also paid by the debtor.

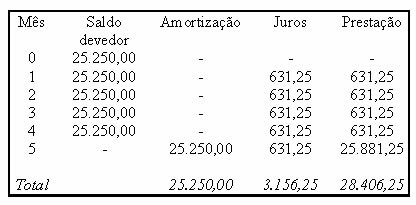

Example 2

Build the spreadsheet and determine the total amount of interest paid on the loan for R$25,250, paid by the US system over 5 months, at a rate of 2.5% per month.

Monthly interest = 2.5% of 25,250.00 = 0.025 * 25,250.00 =

The total amount of interest is equivalent to R$3,156.25.

Do not stop now... There's more after the advertising ;)

by Mark Noah

Graduated in Mathematics

Brazil School Team

Financial math - Math - Brazil School

Would you like to reference this text in a school or academic work? Look:

SILVA, Marcos Noé Pedro da. "American Amortization System"; Brazil School. Available in: https://brasilescola.uol.com.br/matematica/sistema-americano-amortizacao.htm. Accessed on June 29, 2021.