Simple interest is the income earned through an investment with seed capital. They consist of the percentage calculated from this value.

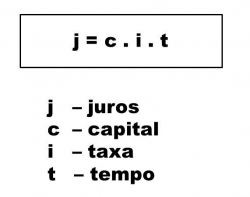

This income is applied to an amount that was borrowed and works as a rent on this loan, with a rate that is defined based on the initial value, the interest rate and time, represented by the equation bellow:

For example, a person has a debt of R$1000.00 (one thousand reais), which must be paid with interest of 8% per month, adopting the simple interest system and this debt must be paid in two months.

The interest calculated for this debt will be:

j = 1000 x 0.08 x 2 = 160

That is, the person in question will pay, in addition to the 1000 reais of the debt, plus 160 reais in interest.

The most important thing when calculating simple interest is the fact that the interest produced in a given period is not accruals, so that they are always the same in all periods in which the investment yields some income.

This is a very common subject in financial mathematics subjects, as banks often use a combining the concepts of commercial and exact interest to calculate interest on short-term financial transactions deadline.

See also the meaning of Fees.

Compound interest

Compound interest is the interest for a given period added to the principal to calculate new interest in subsequent periods.

See more about the meaning of Compound interest.